Eligibility Requirements for a Cash-Out Refinance

Eligibility Requirements for a Cash-Out Refinance

Qualifying for a cash-out refinance requires meeting specific eligibility criteria set by lenders. In this comprehensive guide, we’ll explore the key eligibility requirements for a cash-out refinance, helping you determine if this option is right for you. To understand the cash-out refinance process, it’s helpful to know the basics before diving into eligibility.

What Is a Cash-Out Refinance?

Before diving into eligibility requirements, it’s important to understand what a cash-out refinance entails. Unlike a standard refinance, which replaces your existing mortgage with a new one (often to secure a lower interest rate or adjust terms), a cash-out refinance allows you to borrow more than your current mortgage balance. The excess funds are paid to you in cash, which you can use for virtually any purpose. For a detailed explanation, check out how a cash-out refinance works.

For example, if your home is valued at $400,000 and you owe $200,000 on your mortgage, a cash-out refinance might allow you to refinance for $300,000. After paying off the original $200,000 mortgage, you’d receive $100,000 in cash (minus closing costs and fees).

Key Eligibility Requirements for a Cash-Out Refinance

Lenders impose strict criteria to ensure borrowers can manage the increased loan amount and associated risks. Below are the primary eligibility requirements for a cash-out refinance.

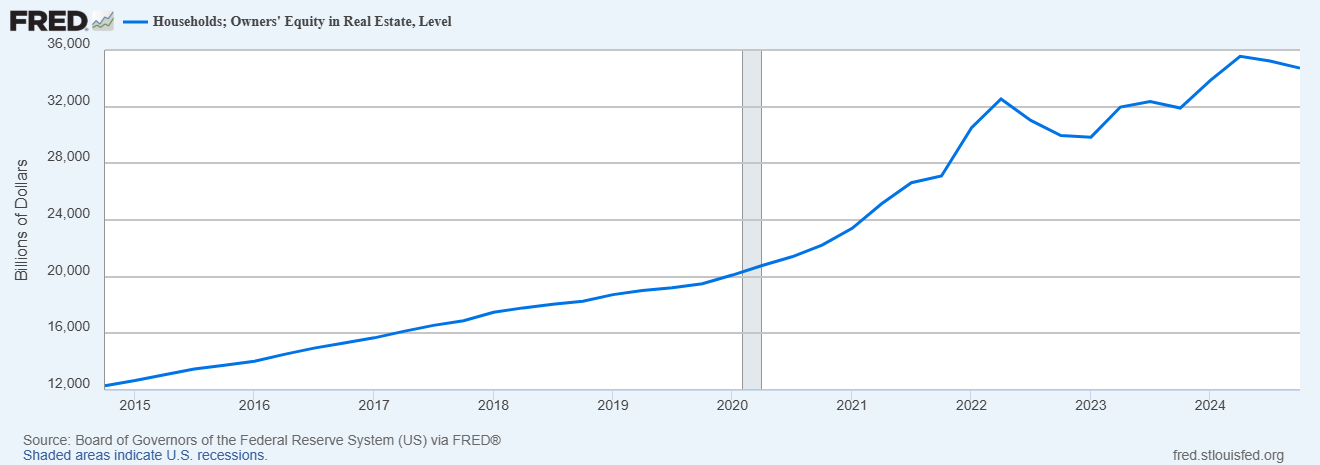

1. Sufficient Home Equity

Home equity is the cornerstone of a cash-out refinance. Equity is the difference between your home’s current market value and the amount you owe on your mortgage. Most lenders require you to maintain at least 20% equity in your home after the cash-out refinance. This means you can typically borrow up to 80% of your home’s value, though some lenders may allow up to 85% for conventional loans or higher for government-backed loans like VA or FHA.

Example: If your home is worth $500,000, and the lender allows an 80% loan-to-value (LTV) ratio, you could borrow up to $400,000. If you owe $250,000 on your current mortgage, you could potentially receive $150,000 in cash, assuming you meet other requirements.

2. Good Credit Score

Your credit score plays a significant role in determining your eligibility for a cash-out refinance. Most lenders require a minimum credit score of 620 for conventional loans, though a score of 680 or higher can improve your chances of securing favorable terms. For FHA loans, the minimum credit score may be as low as 580, while VA loans may not have a strict minimum but still consider creditworthiness.

A higher credit score not only increases your approval odds but also helps you secure a lower interest rate, reducing the overall cost of the loan.

3. Stable Income and Employment

Lenders want assurance that you can repay the new, larger loan. To qualify, you’ll need to demonstrate a stable income and consistent employment history, typically for at least two years. You’ll likely need to provide documentation such as:

- Recent pay stubs

- W-2 forms or tax returns (especially for self-employed borrowers)

- Bank statements

If you’re self-employed, lenders may require additional documentation, such as profit-and-loss statements, to verify your income stability.

4. Low Debt-to-Income Ratio (DTI)

Your debt-to-income (DTI) ratio measures your monthly debt payments relative to your gross monthly income. For a cash-out refinance, lenders typically prefer a DTI ratio of 43% or lower, though some may allow up to 50% for well-qualified borrowers. A lower DTI indicates that you have sufficient income to manage the new loan payment alongside your existing debts.

Calculation: If your monthly debts (including the new mortgage payment) total $3,000 and your gross monthly income is $7,000, your DTI is approximately 43% ($3,000 ÷ $7,000).

5. Property Type and Occupancy

The type of property and its occupancy status can affect your eligibility. Most lenders offer cash-out refinances for primary residences, second homes, and investment properties, but the requirements vary:

- Primary residences: Typically have the most lenient LTV ratios (up to 80–85%).

- Second homes: May have stricter LTV limits (e.g., 75%).

- Investment properties: Often have the lowest LTV ratios (e.g., 70%) and higher interest rates due to increased risk.

Additionally, the property must be in good condition, as lenders will require an appraisal to determine its current market value.

6. Loan Type Restrictions

The type of loan you’re seeking (e.g., conventional, FHA, VA) impacts eligibility. For example:

- Conventional loans: Require higher credit scores and stricter DTI ratios but offer flexibility in LTV.

- FHA loans: Allow lower credit scores and higher LTV ratios (up to 85%) but require mortgage insurance premiums.

- VA loans: Offer generous terms for eligible veterans, including up to 100% LTV in some cases, but require a funding fee.

Check with your lender to understand the specific requirements for your desired loan type.

Additional Considerations

Beyond the core eligibility requirements, consider the following factors when pursuing a cash-out refinance:

- Closing costs: Expect to pay 2–5% of the loan amount in closing costs, which may be rolled into the loan or paid upfront.

- Interest rates: Cash-out refinances often have higher rates than standard refinances. Understanding how a cash-out refinance works can help you weigh these costs.

- Risks: Borrowing against your home equity increases your debt and monthly payments, so ensure you can afford the new loan terms.

Tips to Improve Your Eligibility

If you’re close to qualifying but fall short in certain areas, consider these strategies:

- Boost your credit score: Pay down credit card balances and avoid new debt.

- Reduce your DTI: Pay off high-interest debts, such as credit cards or personal loans.

- Increase your equity: Make extra mortgage payments to reduce your loan balance.

- Shop around: Compare offers from multiple lenders to find the best terms.

Is a Cash-Out Refinance Right for You?

A cash-out refinance can provide valuable funds for financial goals, but it’s not suitable for everyone. Weigh the benefits (access to cash, potential tax deductions for certain uses) against the drawbacks (higher debt, increased monthly payments, closing costs). To make an informed decision, explore how a cash-out refinance works in detail. Consult with a financial advisor or mortgage professional to assess your situation and explore alternatives, such as home equity loans or lines of credit.

Conclusion

Qualifying for a cash-out refinance requires sufficient home equity, a solid credit score, stable income, a low DTI ratio, and adherence to lender-specific guidelines. By understanding these requirements and preparing your finances, you can increase your chances of approval and secure the funds you need. Take the time to research lenders, compare loan options, and make an informed decision that aligns with your long-term financial goals.